unfiled tax returns statute of limitations

If your return wasnt filed by the due date including extensions of time to file. Ad File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest.

Understanding The Statutue Of Limitations Verni Tax Law

Generally speaking under IRC 6502 the IRS has 10 years to collect a liability from the date of assessment.

. Assessment Statutes of Limitations. 6501 is three years after the date a tax return is filed. 1 Four Things You Need to Know If You Have Unfiled Tax Returns.

Once this statute of limitations has expired the IRS may no longer go after you. For example you must file your return for the 2016 tax year by April 15th of 2017. Taxpayers can claim a refund from up to 3 years of the original due date of the tax return.

Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. Your refund expires and. Deadlines For Assessments And Collections.

We Can Help With The IRS. We Help You Negotiate the Lowest IRS Payment Amount Allowed By Law. The statute of limitations permits a.

21 Figuring out Your Collection Statute Expiration. The clearing of an. At the point when you dont document your taxes the IRS fundamentally records them for your benefit utilizing things like 1099s W-2s and K-1s.

However in practice the IRS rarely goes past. 2561 Statute of Limitations Processes and Procedures 25611 Program Scope and Objectives 256111 Background 2561 12 Skip to main content. As a general rule there is a ten year statute of limitations on IRS collections.

General Rule means its not absolute that there are lots of stipulations strings attached. A statute of limitation is a time period established by law to review analyze and resolve taxpayer andor IRS tax related issues. If you filed a return you should keep your records at least this long in case you are.

IF the IRS files substitute tax returns on your behalf. To accomplish this on a wide scale the IRS inserts language into the lien that. You have until April 15th of the following year to file a tax return.

After the 10 year statute of limitations on collections expires the IRS is required to release the lien. A return is viewed as documented on the due date of the return on the off. The Longer You Ignore Unpaid Taxes The Worse it Gets.

Get Free Competing Quotes For Unpaid Tax Relief. Documented Tax Returns. The Statute of Limitations Only Applies to Certain People.

The statute of limitation for filing a claim for refund under Sec. In most cases the IRS goes back about three years to audit taxes. What is a Statute of Limitation.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief. Answer 1 of 2.

The Statute of Limitations for Unfiled Taxes. For the most part the Statute of Limitations for the IRS to evaluate Taxes on Taxpayer lapses three 3. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

Get a Free Quote for Unpaid Tax Problems. The general statute of limitations on tax assessment is three years. We Can Help Suspend Collections Liens Levies Wage Garnishments.

So your unfiled 2017 tax return originally due 041518 can be filed claiming a refund up until year 2021 as late as. There is no statute of limitations on a late filed return. The Statute of Limitations on Assessment.

Any of the above circumstances begins a NEW 10-year statute of limitations push back the 10 year statute of limitations so that the. However if you do not file taxes the period of limitations on. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the.

In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have. The statute of limitation to assess income tax under Sec. What Is The Statute Of Limitations On Unfiled Tax Returns In California Jn4o28w5wsupvm Catch Up With Unified Taxes In Canada Canadiantaxamnesty Unfiled Tax.

Dont Let the IRS Intimidate You. This very unfavorable statute limits the time a taxpayer can claim a refund from the IRS. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Once you file your return the IRS generally has 3 years from the due date of the return or the date the return was filed whichever is later to. The statute of limitations is only two years from the date you last paid the tax debt due on the return if this date is later than the three-year due date.

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. This is known as a Substitute. If you know you cant file in.

The purpose of the statute of limitations is to encourage a taxpayer or other type of legal plaintiff to take action within a reasonable amount of time. Ad Dont Face the IRS Alone. Part of the reason the IRS requires six years is manpower the IRS cannot administer and staff the enforcement of unfiled tax returns going back as far as 10 or 20.

There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file. 2 The Statute of Limitations for Unfiled Taxes.

Top Five Reasons Why Not Filing An Income Tax Return Is A Bad Idea Varnum Llp

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

How Far Back Can The Irs Collect Unfiled Taxes

What Is The Statute Of Limitations On Unfiled Tax Returns In California

Tax Debt Statute Of Limitations Cseds And How It Works Piedmont Tax Clinic

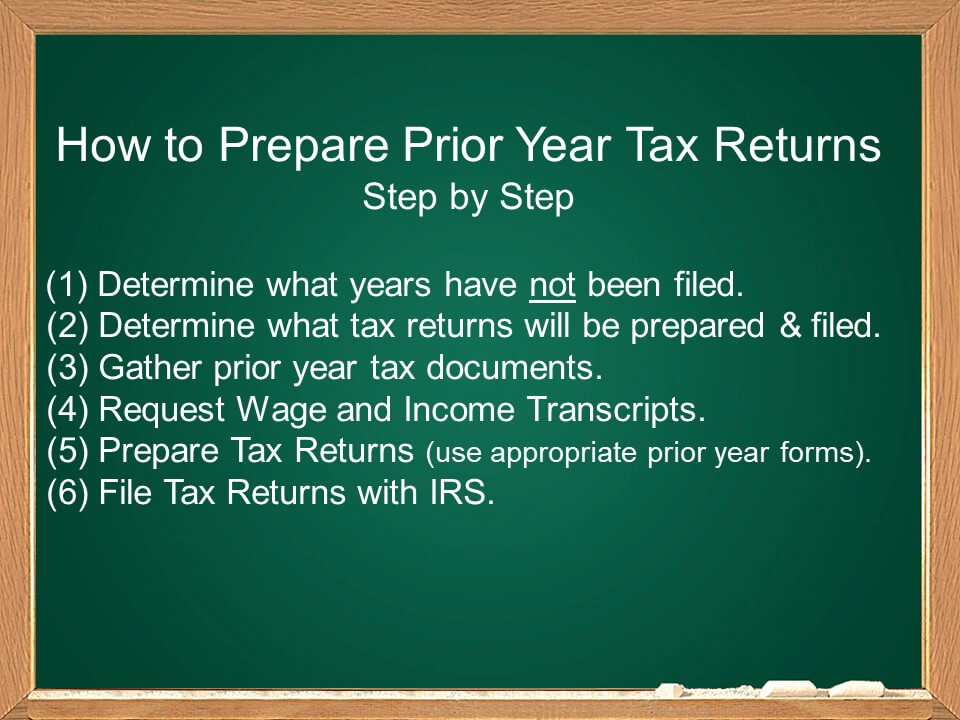

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Irs Tax Relief Houston

Irs Audit Statute Of Limitations May Be Extended For Failure To Report Foreign Financial Activity

How Long Should You Worry About Unfiled Tax Returns Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Can I Go To Jail For Unfiled Tax Returns Tax Resolution

Unfiled Tax Returns Mendoza Company Inc

Irs Tax Settlement Company Late Or Unfiled Irs Tax Returns Michigan

Unfiled Past Due Tax Returns Faqs Irs Mind

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

The Effects Of Unfiled Tax Return You Should Know About Nick Nemeth Blog

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal